Blog

Retirement Planning helps Setup your strategy for a happy retirementRetirement Planning is something that most Filipinos are unfamiliar with.

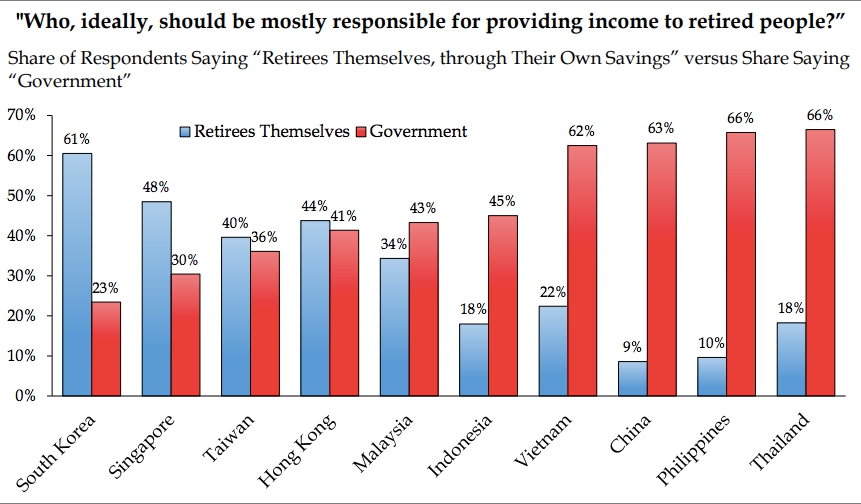

This has been an obvious finding in past surveys performed by the Global Aging Institute. Many countries in East Asia still suffer from the reliance syndrome wherein old people rely on their children to finance their retirement. In 2016, Philippines ranked first among surveyed countries who think that the government should be responsible for providing income for retired persons.

Looking at the same 2016 survey, South Korea had the best response and mindset when it comes to retirement. 61% of the respondents say that retirees themselves have the responsibility of growing their own retirement income. For the Philippines, 66% say otherwise.

Source: Wave 2 of East Asia Retirement Survey by Global Aging Institute, 2016

Source: Wave 2 of East Asia Retirement Survey by Global Aging Institute, 2016

Why do Filipinos rely on the government for retirement income?

If we analyze Philippine history, Filipinos are largely familial wherein extended families live under the same roof or compound until they can no longer fit. This may be why many ancestral homes are huge! When you have an extended family living in the same household, there will always be young people who are actively earning and supporting those who are already retired.

Many Filipinos also have the mindset that SSS pension plans will be enough. Sadly, those who are already receiving their SSS pension money say that the amount won’t be able to sustain the same lifestyle. Since it isn’t enough, they change their lifestyles to make the income fit.

People have to realize that, when you’re used to receiving a good amount of income, your lifestyle becomes attuned to that source of income. When that source and income are gone, life gets disrupted.

This means that the more income you earn, the more you spend. In turn, the more you spend means you need more retirement income to retain your lifestyle.

REALIZATION

“You can be young without money,

but you can’t be old without it.”

Tennessee Williams, American Playwright

Details

Retirement Planning – When to Start?

It is never too late to start building your retirement income unless you are already at the retirement age.

Although, we have to keep in mind that the sooner you start, the more time your money has to grow. The common advice that retirement planners and coaches give is that people in their twenties need to save at least 20% of their annual income for their retirement plans.

Considering the average of income of twenty year olds to be at Php 20,000, their annual income equates to 240,000. Twenty percent of that is 48,000 or 4,000 monthly.

At a 10% interest rate, a 25-year old can have a projected income of 13.3 Million Pesos if he saves 4,000 monthly. All he has to do is invest in the right financial vehicles that have the potential to gain a 10% interest.

Bottomline is that you have to start preparing if you want to retire in your own terms.

Try this Retirement Calculator from MSN.

Retirement Planning – What if you start late?

Retirement Planning relies on five main things: (1) The amount you save; (2) the amount of time you can grow it; (3) the interest that your savings can earn; (4) what are the assets that can give you income upon retirement; and (5) your retirement fund goal.

The answer to this question can actually be derived from the first three factors alone.

If you start late, you have to save more. If a 25-year old needs to save 20% of his annual income for his retirement plan, someone in their 40s or 50s need to invest or save more. Ten to twenty percent will not be enough if you start late, because you have less time to let it grow.

In other words, you have to allocate more of your income to retirement savings if you start later in life.

Generally, people in their 40s need to save up at least 25% of their income. Those in their 50s need to save up at least 45%, or they have to lower their retirement income expectations if they can’t afford to save up this amount.

REALIZATION

“The sooner you prepare for retirement, the younger you can retire.”

Mike Togle, Retirement Coach

Start your Retirement Planning Today

One way to start is understanding what stage of Retirement Planning you’re at right now. Regardless of age, everyone is at a particular stage and the key is trying to get to the next.

A plan will always be just a plan until it is implemented.

I also believe that a plan is just a guide to what needs to be done. It cannot be set in stone, especially when it comes to money, which is affected by different factors. Adjustments have to be made along the way.

In Design Thinking, crafted plans need to be tested and refined before implementation. And the monitoring, testing, and refinement continues as the

The important thing is you have to start today. The longer you wait, the less time your investments have to grow.

If you’re lost, you can contact your financial consultant. Most of us don’t charge for consultations, and we can help assess your current financial situation and offer you paths to move forward. We provide solutions.

Start retirement planning today!

10F Ayala North Exchange Tower 1

Ayala Avenue, Makati City, PH

[email protected]

0 Comments