BLOG

How Important is a Savings Method for Your Financial Health?It’s the middle of the month and you have just received your mid-month pay, but why do you feel like you still have more bills to pay and not enough income? Did your savings method fail you?

How familiar is this situation for you?

Many of us struggle to keep our finances in check.

Most of the time, we just take care of the bills when they come. If we don’t have enough, then we go look for additional income to pay for the bills. A lot of times, it becomes challenging especially with the loans, amortization and other liabilities.

And many times it becomes impossible when an emergency strikes.

But don’t fret!

It’s never too late to start fixing up your finances in order to maximize your income and have a more comfortable life and achieve financial freedom.

Monitor where Your Money Goes

My clients’ usual financial challenges before our consultation was they had little to no idea where their income goes. Supposedly, when you ask yourself where you spent all your money, you should have a fair idea where you put them.

Is it on grocery, rent for your home, or did you invest most of it?

When you can’t establish where you put your money, then it becomes difficult to fix your budget and re-allocate your income to the proper items.

You can go for budget mangement apps or a simple ledger or notebook will be a good start.

What matters is you start keeping track of your income allocation.

Speaking of income allocation and budget management, here is a couple of savings methods that you can follow: The STE/SDE and the 50-30-20 method.

Savings and Tithes before Expenses Savings Method

Also known as the 70-20-10 method, this income allocation strategy suggests that you set aside income for Savings (20%) and Tithes (10%) before spending the remaining 70%. Some have repurposed this to Savings and Debts before Expenses while indicating that 10% must be set aside to pay off debts and loans.

This method builds your discipline in setting money aside for savings and investments and expenses that need to be settled before buying anything else.

Savings and Investments will be critical for emergencies and for better financial security in the future. It will be your life blood and source of income for a better retirement journey.

Many fail to save up for the time when they retire, which leads to a troublesome quality of life.

Try out this method and save yourself the headache and heartache.

50-30-20 Savings Method

This is the method I’ve come to appreciate and use for our household income.

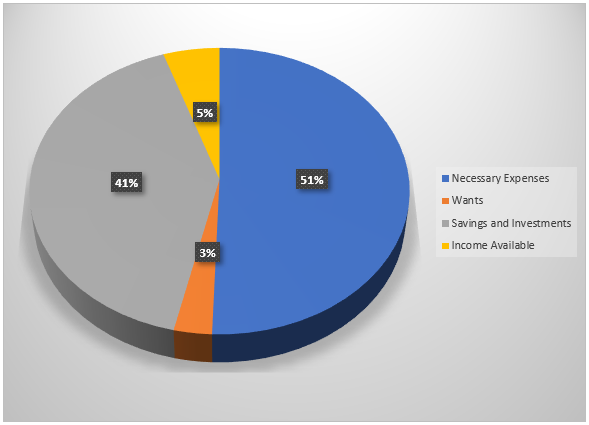

The 50-30-20 method categorizes your spending into 3 categories: 50% for Needs, 30% for Wants, and 20% for Savings and Investments.

The method allows you more flexibility on what you consider to be your needs, your savings and investments, and what your wants are.

While there are basic necessities that we all need like food, shelter, and clothing, I suggest you also include technology, insurance, and building an emergency fund under your NEEDS. Shelter already incorporates the rent or amortization that you need to settle periodically along with your monthly utilities.

Savings and Investments will include your Bank Cash Savings, stock market, bonds, mutual funds, UITF, and real estate property that you either invest on regularly or the amortization that you need to settle periodically.

But don’t include the amortization you pay for your home or else you’ll double book that item, which is already in your basic necessities.

The remainder then becomes available for your wants or extra expenses. This will include the additional food that you buy, a watch, or an extra car perhaps.

Dining out may not be that feasible these days, but having expensive food delivered is synonymous to eating at a fancy place with friends. Sometimes it may even be more expensive due to the delivery fees.

Details

An Income Allocation Spreadsheet

And I’ve come up with this simple spreadsheet that may help you do just that.

It’s a simple Excel spreadsheet that lets you monitor your expenses and keep it in check relative to your monthly net income.

There are separate tabs for your Needs, Wants, and Investments where you can add items as you spend or allocate income to them. The spreadsheet will simply aggregate the monetary values into the first tab which will assess and give you a high level suggestion.

In case you don’t have one yet, then this will be very useful for you to manage your income on a monthly basis. We’re still building the annualized version so watch out for that.

I know you also wanna check out and try the spreadsheet, so just click the button below to get a copy.

REALIZATION

“Improving your Financial Health starts with a better understanding of where your money goes. ”

0 Comments